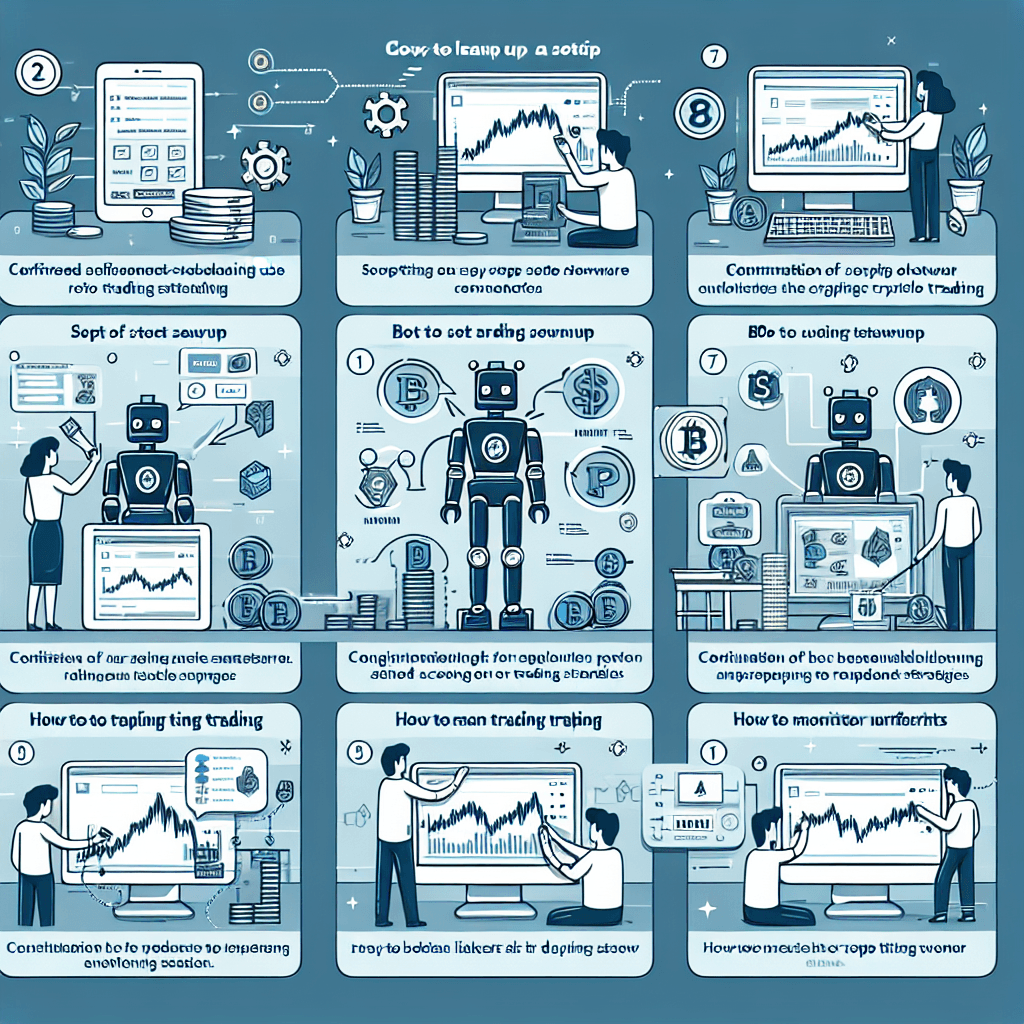

How to Set Up and Use a Crypto Trading Bot

The world of cryptocurrency trading is filled with opportunities and challenges. For many traders, maximizing profit comes with the aid of technology—specifically, crypto trading bots. These automated tools help traders execute trades efficiently based on predefined criteria. This article will provide a comprehensive guide on how to set up and use a crypto trading bot effectively.

What is a Crypto Trading Bot?

A crypto trading bot is a software application that interacts with various cryptocurrency exchanges to automate trading activities. These bots use algorithms to analyze market data, execute trades in real-time, and help traders capitalize on market fluctuations without constant supervision.

Advantages of Using Crypto Trading Bots

Before diving into the setup process, it’s essential to understand the benefits of using trading bots:

- 24/7 Trading: Bots can trade around the clock, ignoring human limitations and time zones.

- Emotionless Trading: Bots operate on algorithms, eliminating emotional biases that often lead to poor trades.

- Quick Decision-Making: They can analyze market trends and execute trades in milliseconds—much faster than a human trader.

- Backtesting Capabilities: Trading bots allow you to test strategies using historical data before investing real money.

Setting Up Your Crypto Trading Bot

Setting up a crypto trading bot may seem daunting, but it can be straightforward with the right guidance. Here's a step-by-step process to help you get started:

1. Choose a Reliable Trading Bot

There are several trading bots available, ranging from beginner-friendly to advanced professional tools. Some popular options include:

- 3Commas: Known for its easy interface and smart trading features.

- Cryptohopper: Offers a marketplace for strategies and allows users to automate trading on various exchanges.

- HaasOnline: A more advanced option for experienced traders interested in developing custom scripts.

2. Create an Account

After choosing your bot, sign up for an account. This usually involves providing your email, creating a password, and verifying your identity if necessary.

3. Connect to Your Exchange

Next, link your crypto exchange account to the trading bot. APIs (Application Programming Interfaces) will allow the bot to execute trades on your behalf. Always follow these security tips:

- Use strong, unique passwords for your exchange account.

- Enable two-factor authentication (2FA).

- Limit the bot's permissions (for example, disable withdrawal options).

4. Configure Your Trading Strategy

Setting the right strategy is crucial for successful trading. Some common strategies include:

- Arbitrage: Buying an asset on one exchange and selling it at a higher price on another.

- Market Making: Providing liquidity by placing both buy and sell orders.

- Trend Following: Analyzing market trends and executing trades based on detected patterns.

Most bots will have a variety of built-in strategies, but feel free to customize or create your own based on your trading goals and risk tolerance.

5. Start Trading

Once your bot has been set up and your strategy is configured, it’s time to let it trade. Monitor its performance regularly to ensure that it operates as expected.

Understanding Risks and Limitations

While trading bots can generate profits, they are not foolproof and come with inherent risks:

- Market Volatility: Cryptocurrencies are highly volatile, and bots may not react to sudden market changes effectively.

- Technical Failure: Software bugs or connection issues can lead to missed opportunities or losses.

- Misconfigured Bots: Poorly configured strategies can lead to significant losses, especially for inexperienced traders.

Case Study: A Success with Crypto Trading Bots

A notable example of effective crypto trading bot usage comes from a trader who used 3Commas to automate their trading strategy focused on Bitcoin and Ethereum. By backtesting their strategy over three months, they adjusted their trading parameters and ended up realizing a profit of approximately 25% within the following two months without needing constant monitoring. This success highlights the potential of using trading bots with a well-thought-out strategy.

Conclusion

In summary, crypto trading bots can serve as valuable tools for both novice and experienced traders, providing 24/7 trading, emotionless execution, and the ability to automate complex strategies. By following the steps outlined above, you can set up and utilize a crypto trading bot tailored to your trading style. However, it is crucial to remain vigilant and aware of the risks involved in automated trading. As always, conduct thorough research and consider starting with a demo account or minimal investment to gain experience before fully committing your funds.