How to Use Support and Resistance Levels in Crypto Trading

In the volatile world of cryptocurrency trading, successfully navigating price fluctuations is essential for investors looking to maximize their profits. One of the fundamental concepts traders use to analyze price movements is the identification of support and resistance levels. Understanding these levels can significantly enhance trading strategies and provide clearer insights into market behavior. This article will explore how to effectively utilize support and resistance levels in crypto trading, illustrated with practical examples and key insights.

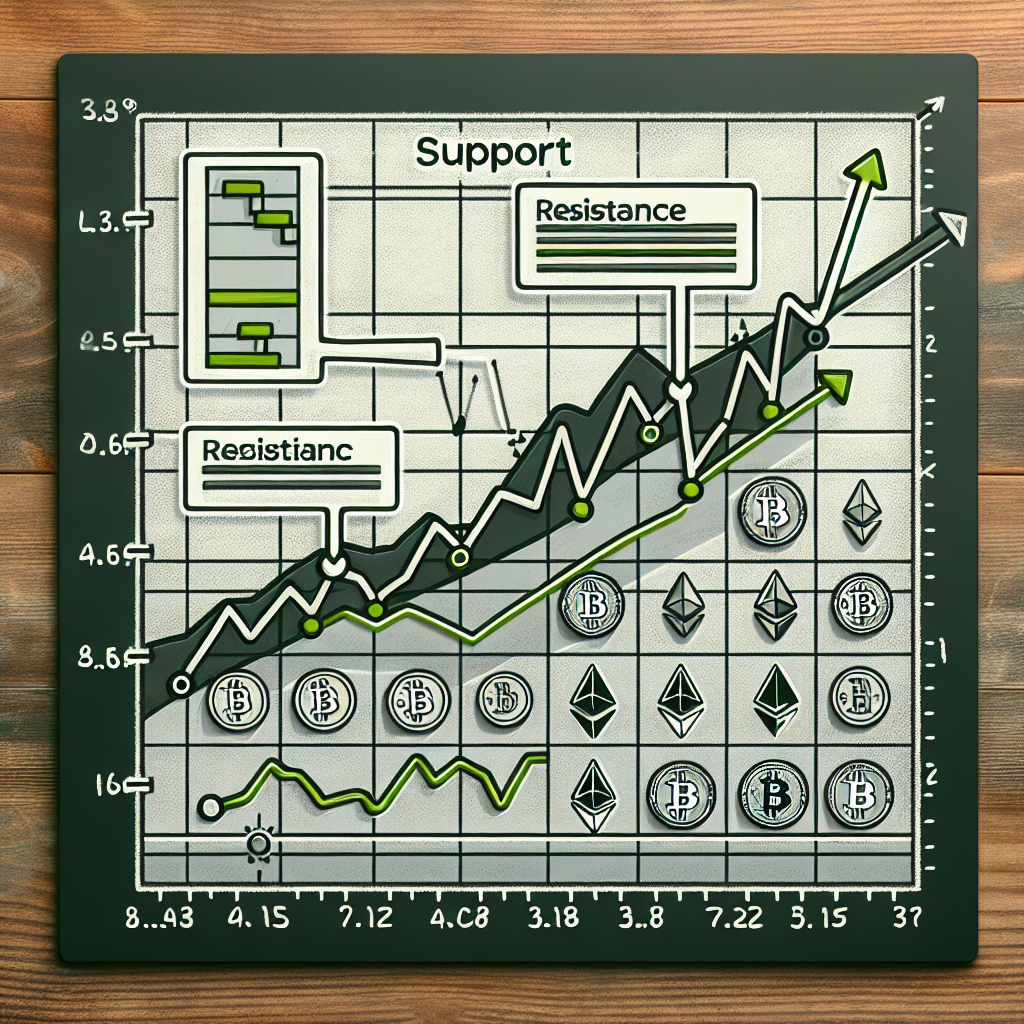

What are Support and Resistance Levels?

Support and resistance levels are critical concepts in technical analysis, helping traders make informed buying and selling decisions. Here’s a breakdown of each term:

- Support Level: This is the price level where buying interest is strong enough to overcome selling pressure, preventing the price from falling further. In other words, it acts as a ‘floor' for the price.

- Resistance Level: Conversely, resistance levels are where selling interest is strong enough to impede price advances. It serves as a ‘ceiling' that the price struggles to break through.

Why are Support and Resistance Levels Important?

Understanding these levels is crucial for effective trading, for several reasons:

- Decision Making: Traders can make informed decisions about when to enter or exit positions based on how the price reacts at these levels.

- Market Psychology: Support and resistance levels often reflect collective market sentiment, showing where traders believe an asset is undervalued or overvalued.

- Trend Confirmation: Identifying these levels can help confirm trends, allowing traders to ride the momentum in a bullish or bearish market.

How to Identify Support and Resistance Levels

Identifying support and resistance levels can be accomplished through various methods:

- Historical Price Levels: Look for past price points where the asset bounced back (support) or reversed (resistance).

- Trend Lines: Drawing trend lines on price charts helps visualize these critical levels. An upward trend line can indicate support, while a downward trend line can highlight resistance.

- Moving Averages: Common moving averages, such as the 50-day or 200-day, can also act as dynamic support and resistance levels.

- Fibonacci Retracement Levels: This method utilizes Fibonacci levels to determine potential support and resistance during price corrections within a trend.

Practical Trading Strategies Using Support and Resistance

Once you’ve identified support and resistance levels, you can develop trading strategies to capitalize on market movements. Here are several approaches:

- Buy Near Support: Enter a long position when the price approaches a robust support level, as these points often signal potential price rebounds.

- Sell Near Resistance: Open a short position near established resistance levels, as they frequently represent areas where the price may decline.

- Breakout Trading: When prices break through resistance levels with strong volume, it can indicate a bullish continuation, while breaking below support levels often signals bearish trends.

Case Study: Bitcoin's Historical Price Movement

Bitcoin (BTC) is a prime example of how support and resistance levels have played a vital role in its price movements. For instance:

- In early 2021, Bitcoin rallied to reach a resistance level of approximately $64,000, facing repeated rejection at that price point.

- Subsequent corrections led it to establish a support level around $30,000, where it bounced back multiple times before attempting another rally.

This oscillation illustrates how recognizing these levels can be beneficial in predicting price behavior and making strategic trading decisions.

Conclusion

Support and resistance levels are invaluable tools in the arsenal of crypto traders. By understanding the psychology behind these levels and employing effective strategies to use them, traders can enhance their decision-making processes and improve their overall profitability. Key takeaways include the importance of identifying historical price points, utilizing various technical analysis tools, and applying tailored trading strategies to exploit market movements. As the cryptocurrency landscape continues to evolve, staying informed and adapting to these fundamental concepts remains crucial for success.